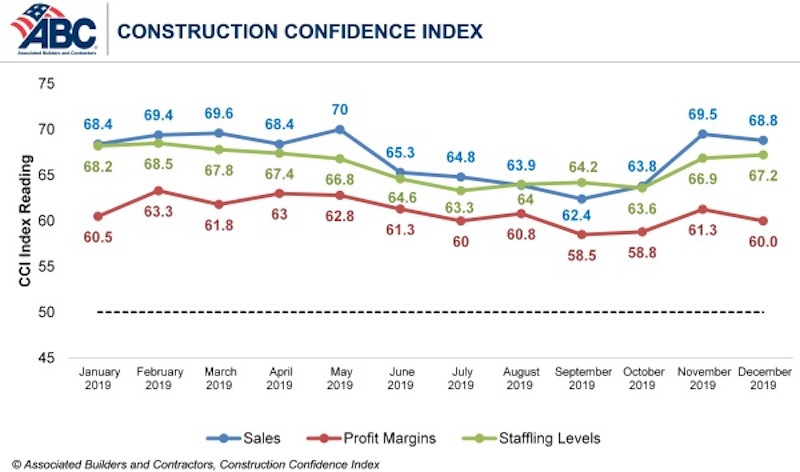

Confidence among U.S. construction industry leaders held steady in December 2019 after surging in November, according to the Associated Builders and Contractors Construction Confidence Index released today. The average American contractor entered 2020 with confidence: Sales expectations, profit margins and staffing levels all remained above the growth expectations threshold, indicating a strong start to 2020.

70% of contractors expect their sales to increase over the first half of 2020, while nearly the same percentage of contractors expect to increase their staffing levels. Nearly half of contractors expect their profit margins to increase, while just 12% expect them to decline over the next two quarters.

- The CCI for sales expectations decreased from 69.5 to 68.8 in December.

- The CCI for profit margin expectations decreased from 61.3 to 60.

- The CCI for staffing levels increased from 66.9 to 67.2

“The U.S. economy is humming, and among the principal beneficiaries of that performance are nonresidential contractors,” said ABC Chief Economist Anirban Basu. “Sales expectations, despite inching a bit lower in December, remain especially robust, with seven in 10 survey respondents expecting sales increases and fewer than one in 10 expecting their sales to decline during the first half of 2020. Recently released data regarding construction spending and hiring in the U.S. strongly suggest that this confidence is justified. ABC’s Construction Backlog Indicator dipped in December but still indicates that contractors remain busy.

“Despite broad optimism regarding sales prospects, contractors’ expectations are somewhat more subdued regarding profit margins,” said Basu. “Though materials prices have been generally stable and energy prices have declined recently, workers are becoming more expensive, both in terms of wages and benefits. Shortfalls in the skilled trades are apparent throughout the nation, especially in the booming markets of the South and West. With U.S. unemployment hovering near a 50-year low, many construction workers may find opportunities in other segments, including logistics, and retirement rates remain elevated. All of this translates into ongoing increases in compensation costs and a squeeze on margins.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

Related Stories

Multifamily Housing | Feb 15, 2018

United States ranks fourth for renter growth

Renters are on the rise in 21 of the 30 countries examined in RentCafé’s recent study.

Market Data | Feb 1, 2018

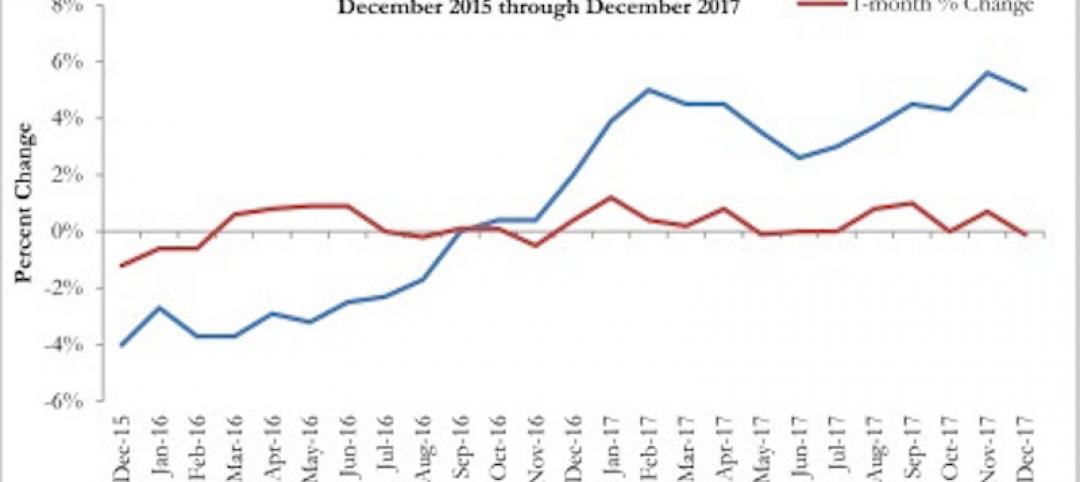

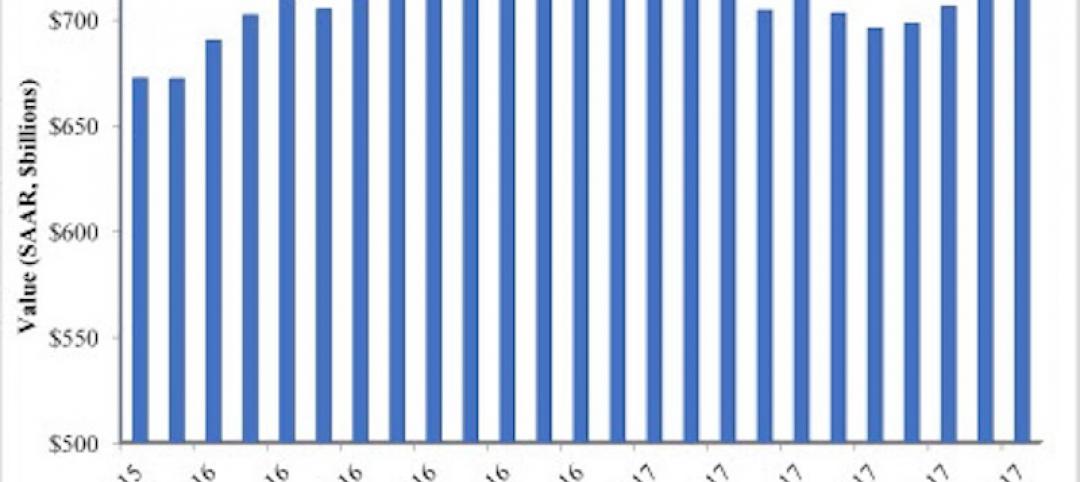

Nonresidential construction spending expanded 0.8% in December, brighter days ahead

“The tax cut will further bolster liquidity and confidence, which will ultimately translate into more construction starts and spending,” said ABC Chief Economist Anirban Basu.

Green | Jan 31, 2018

U.S. Green Building Council releases annual top 10 states for LEED green building per capita

Massachusetts tops the list for the second year; New York, Hawaii and Illinois showcase leadership in geographically diverse locations.

Industry Research | Jan 30, 2018

AIA’s Kermit Baker: Five signs of an impending upturn in construction spending

Tax reform implications and rebuilding from natural disasters are among the reasons AIA’s Chief Economist is optimistic for 2018 and 2019.

Market Data | Jan 30, 2018

AIA Consensus Forecast: 4.0% growth for nonresidential construction spending in 2018

The commercial office and retail sectors will lead the way in 2018, with a strong bounce back for education and healthcare.

Market Data | Jan 29, 2018

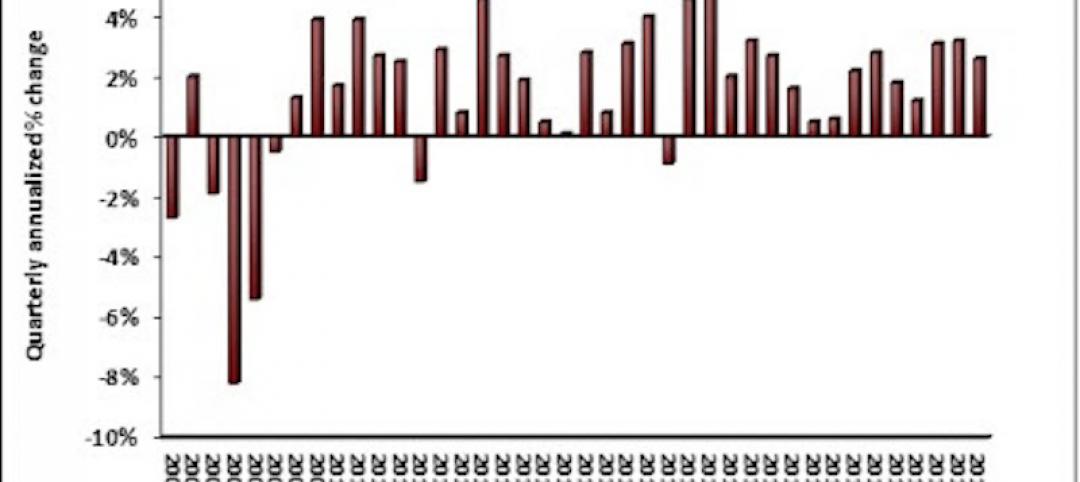

Year-end data show economy expanded in 2017; Fixed investment surged in fourth quarter

The economy expanded at an annual rate of 2.6% during the fourth quarter of 2017.

Market Data | Jan 25, 2018

Renters are the majority in 42 U.S. cities

Over the past 10 years, the number of renters has increased by 23 million.

Market Data | Jan 24, 2018

HomeUnion names the most and least affordable rental housing markets

Chicago tops the list as the most affordable U.S. metro, while Oakland, Calif., is the most expensive rental market.

Market Data | Jan 12, 2018

Construction input prices inch down in December, Up YOY despite low inflation

Energy prices have been more volatile lately.

Market Data | Jan 4, 2018

Nonresidential construction spending ticks higher in November, down year-over-year

Despite the month-over-month expansion, nonresidential spending fell 1.3 percent from November 2016.