While federal government proposals calling for $1 trillion in infrastructure spending would be credit positive for state and local economies, several constraints suggest that investment will be slow to ramp up, according to Moody’s Investors Service in a new report. Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Budget pressure at all levels of U.S. government in recent years has limited the ability to adequately reinvest in the nation’s critical infrastructure. Both parties in Washington have called for initiatives to address the funding gap, but disagreements over private sector involvement may prevent progress toward a consensus.

“Either proposal would amount to a $100 billion annual increase in spending on infrastructure,” says AJ Sabatelle, a Moody’s Managing Director and the lead author of the report. “But finding a reasonable balance between direct government spending and private investment will take time.”

In addition to political disagreement, regulatory approval issues like environmental reviews and litigation can slow the rate at which new infrastructure projects can materialize, according to the report, “US Infrastructure: Large Increase in US Infrastructure Spending Will Be Slow to Develop.” Meaningful acceleration of lead times for new projects would likely require regulatory reform involving federal, state and local agencies or passage of new legislation.

Practical considerations regarding the pace at which new projects can proceed are also likely to hamper near-term investment.

“Such a rapid increase would pose significant challenges to large engineering and construction firms, which would need to hire and train new project managers and locate skilled laborers,” says Sabatelle. “The sector is going to need time to gear up.”

If private capital is to play a significant role in facilitating the increase in infrastructure spending, the use of public-private partnerships (P3s) will likely be necessary. While the pipeline has grown, P3s currently fund less than 5% of annual infrastructure investment. Moody’s anticipates continued evolution of public policy and additional legislative action that promotes P3s and simplifies their legal framework.

Related Stories

Multifamily Housing | Aug 19, 2019

Top 10 outdoor amenities in multifamily housing for 2019

Top 10 results in the “Outdoor Amenities” category in our Multifamily Design+Construction Amenities Survey 2019.

Multifamily Housing | Aug 12, 2019

Multifamily Amenities 2019: Rethinking the $30,000 cup of coffee

What amenities are “must-have” rather than “nice to have” for the local market? Which amenities will attract the renters or buyers you’re targeting? The 2019 Multifamily Amenities Survey measured 113 amenity choices.

Codes and Standards | Jun 27, 2019

Public restrooms being used for changing clothes, phone conversations, and 'getting away'

About 60% of Americans use a public restroom one to five times a week, according to the latest annual hand washing survey conducted by Bradley Corporation.

Industry Research | Jun 11, 2019

New research suggests individual work spaces increase productivity

The research was conducted by Perkins Eastman and Three H.

Industry Research | Apr 8, 2019

New research finds benefits to hiring architectural services based on qualifications

Government agencies gain by evaluating beyond price, according to a new Dodge survey of government officials.

Office Buildings | Jul 17, 2018

Transwestern report: Office buildings near transit earn 65% higher lease rates

Analysis of 15 major metros shows the average rent in central business districts was $43.48/sf for transit-accessible buildings versus $26.01/sf for car-dependent buildings.

Market Data | May 29, 2018

America’s fastest-growing cities: San Antonio, Phoenix lead population growth

San Antonio added 24,208 people between July 2016 and July 2017, according to U.S. Census Bureau data.

Industry Research | Jan 30, 2018

AIA’s Kermit Baker: Five signs of an impending upturn in construction spending

Tax reform implications and rebuilding from natural disasters are among the reasons AIA’s Chief Economist is optimistic for 2018 and 2019.

Market Data | Jan 30, 2018

AIA Consensus Forecast: 4.0% growth for nonresidential construction spending in 2018

The commercial office and retail sectors will lead the way in 2018, with a strong bounce back for education and healthcare.

Market Data | Jan 29, 2018

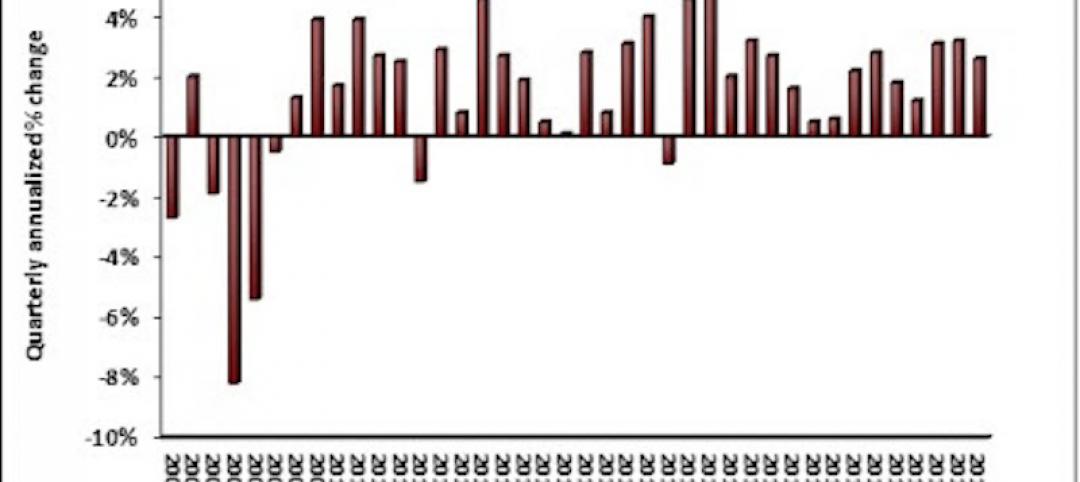

Year-end data show economy expanded in 2017; Fixed investment surged in fourth quarter

The economy expanded at an annual rate of 2.6% during the fourth quarter of 2017.