While federal government proposals calling for $1 trillion in infrastructure spending would be credit positive for state and local economies, several constraints suggest that investment will be slow to ramp up, according to Moody’s Investors Service in a new report. Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Budget pressure at all levels of U.S. government in recent years has limited the ability to adequately reinvest in the nation’s critical infrastructure. Both parties in Washington have called for initiatives to address the funding gap, but disagreements over private sector involvement may prevent progress toward a consensus.

“Either proposal would amount to a $100 billion annual increase in spending on infrastructure,” says AJ Sabatelle, a Moody’s Managing Director and the lead author of the report. “But finding a reasonable balance between direct government spending and private investment will take time.”

In addition to political disagreement, regulatory approval issues like environmental reviews and litigation can slow the rate at which new infrastructure projects can materialize, according to the report, “US Infrastructure: Large Increase in US Infrastructure Spending Will Be Slow to Develop.” Meaningful acceleration of lead times for new projects would likely require regulatory reform involving federal, state and local agencies or passage of new legislation.

Practical considerations regarding the pace at which new projects can proceed are also likely to hamper near-term investment.

“Such a rapid increase would pose significant challenges to large engineering and construction firms, which would need to hire and train new project managers and locate skilled laborers,” says Sabatelle. “The sector is going to need time to gear up.”

If private capital is to play a significant role in facilitating the increase in infrastructure spending, the use of public-private partnerships (P3s) will likely be necessary. While the pipeline has grown, P3s currently fund less than 5% of annual infrastructure investment. Moody’s anticipates continued evolution of public policy and additional legislative action that promotes P3s and simplifies their legal framework.

Related Stories

Market Data | Jan 25, 2018

Renters are the majority in 42 U.S. cities

Over the past 10 years, the number of renters has increased by 23 million.

Market Data | Jan 12, 2018

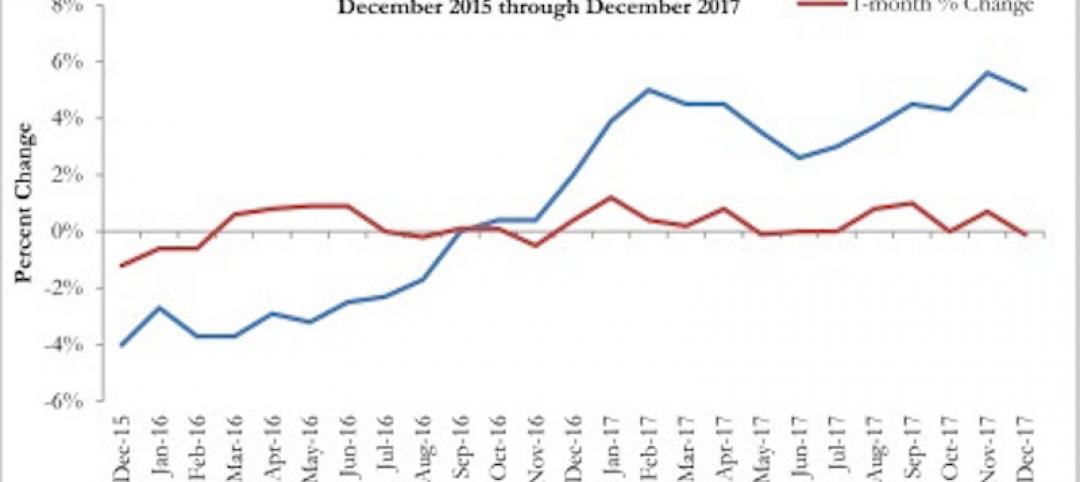

Construction input prices inch down in December, Up YOY despite low inflation

Energy prices have been more volatile lately.

Market Data | Jan 4, 2018

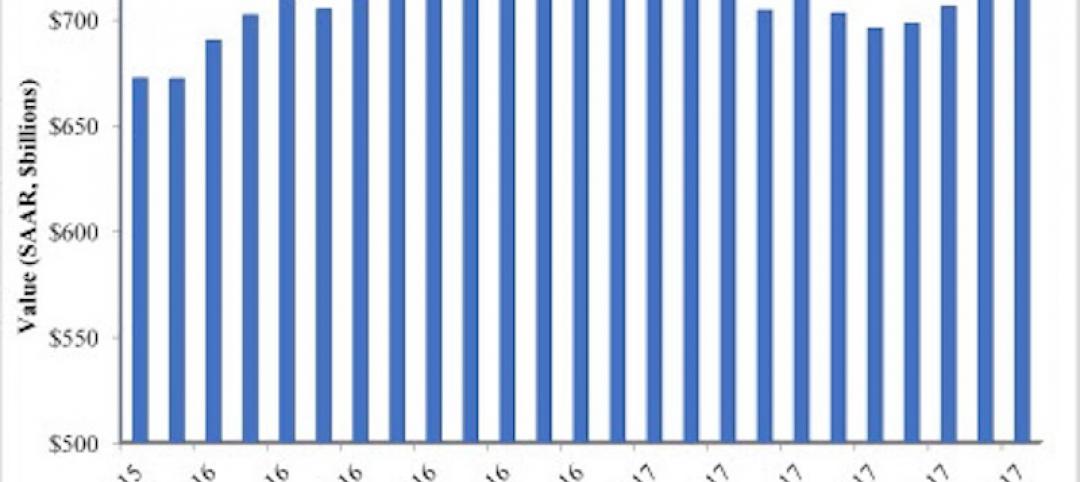

Nonresidential construction spending ticks higher in November, down year-over-year

Despite the month-over-month expansion, nonresidential spending fell 1.3 percent from November 2016.

Market Data | Dec 14, 2017

ABC chief economist predicts stable 2018 construction economy

There are risks to the 2018 outlook as a number of potential cost increases could come into play.

Market Data | Dec 11, 2017

Global hotel construction pipeline is growing

The Total Pipeline stands at 12,427 Projects/2,084,940 Rooms.

Market Data | Dec 11, 2017

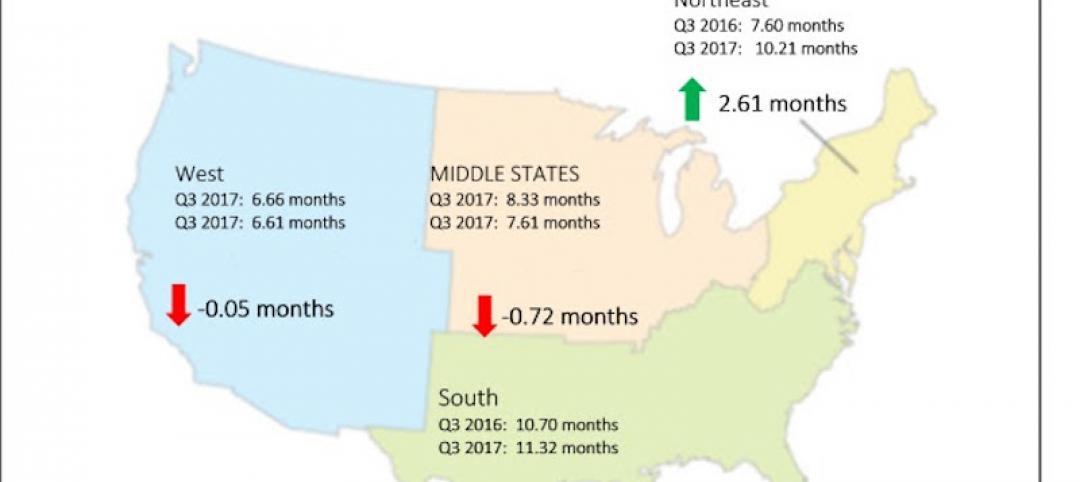

Construction backlog surges, sets record in third quarter

CBI is a leading economic indicator that reflects the amount of construction work under contract, but not yet completed.

Market Data | Dec 7, 2017

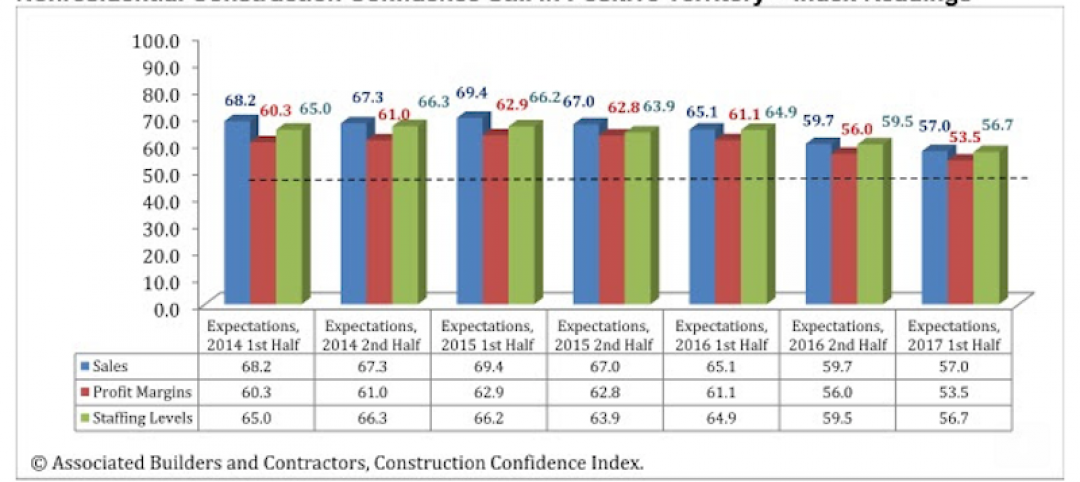

Buoyed by healthy economy, ABC Index finds contractors upbeat

Despite rising construction labor and materials costs, 55% of contractors expect their profit margins to expand in the first half of 2018.

Industry Research | Nov 28, 2017

2018 outlook: Economists point to slowdown, AEC professionals say ‘no way’

Multifamily housing and senior living developments head the list of the hottest sectors heading into 2018, according a survey of 356 AEC professionals.

Architects | Nov 28, 2017

Adding value through integrated technology requires a human touch

To help strike that delicate balance between the human and the high-tech, we must first have an in-depth understanding of our client’s needs as well as a manufacturer’s capabilities.

Market Data | Nov 27, 2017

Construction's contribution to U.S. economy highest in seven years

Thirty-seven states benefited from the rise in construction activity in their state, while 13 states experienced a reduction in activity.