While federal government proposals calling for $1 trillion in infrastructure spending would be credit positive for state and local economies, several constraints suggest that investment will be slow to ramp up, according to Moody’s Investors Service in a new report. Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Budget pressure at all levels of U.S. government in recent years has limited the ability to adequately reinvest in the nation’s critical infrastructure. Both parties in Washington have called for initiatives to address the funding gap, but disagreements over private sector involvement may prevent progress toward a consensus.

“Either proposal would amount to a $100 billion annual increase in spending on infrastructure,” says AJ Sabatelle, a Moody’s Managing Director and the lead author of the report. “But finding a reasonable balance between direct government spending and private investment will take time.”

In addition to political disagreement, regulatory approval issues like environmental reviews and litigation can slow the rate at which new infrastructure projects can materialize, according to the report, “US Infrastructure: Large Increase in US Infrastructure Spending Will Be Slow to Develop.” Meaningful acceleration of lead times for new projects would likely require regulatory reform involving federal, state and local agencies or passage of new legislation.

Practical considerations regarding the pace at which new projects can proceed are also likely to hamper near-term investment.

“Such a rapid increase would pose significant challenges to large engineering and construction firms, which would need to hire and train new project managers and locate skilled laborers,” says Sabatelle. “The sector is going to need time to gear up.”

If private capital is to play a significant role in facilitating the increase in infrastructure spending, the use of public-private partnerships (P3s) will likely be necessary. While the pipeline has grown, P3s currently fund less than 5% of annual infrastructure investment. Moody’s anticipates continued evolution of public policy and additional legislative action that promotes P3s and simplifies their legal framework.

Related Stories

Market Data | Aug 2, 2017

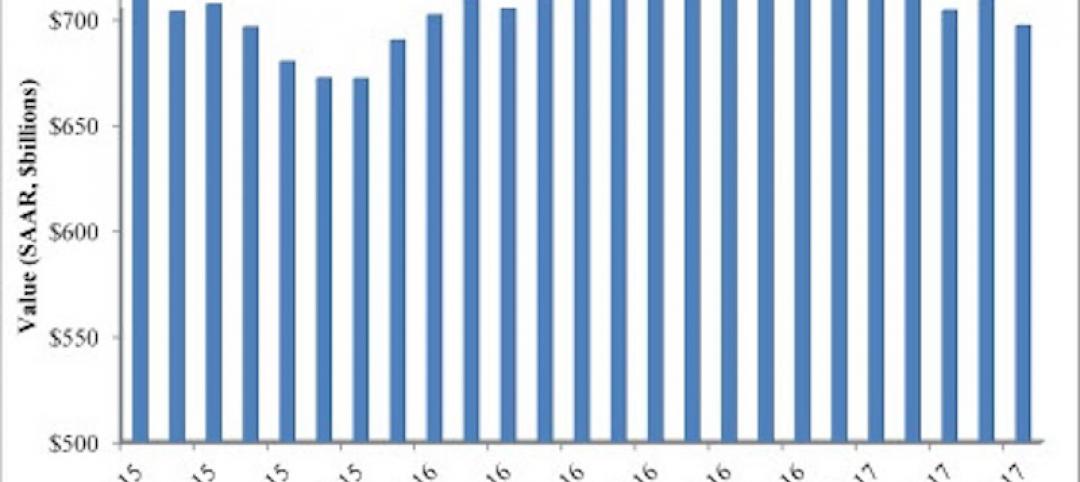

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

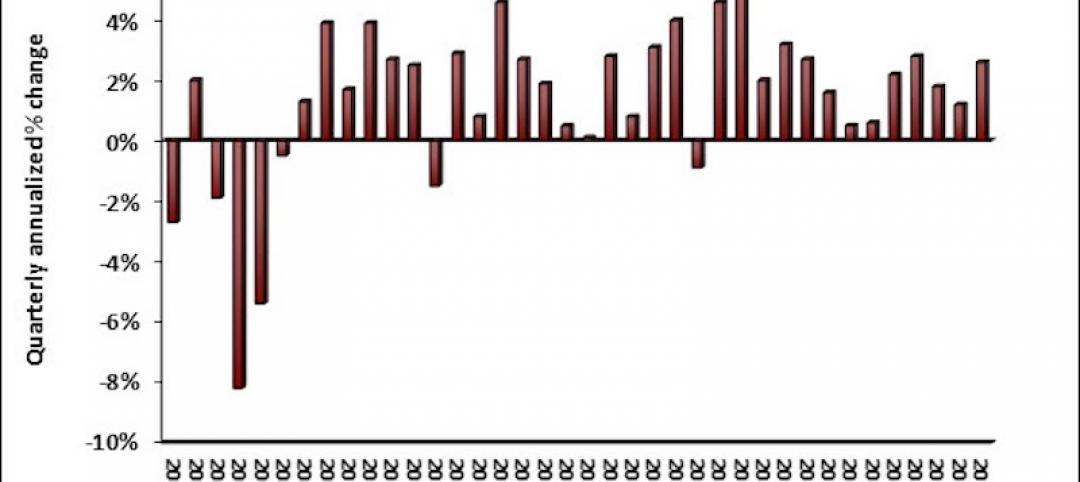

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Game rooms and game simulators popular amenities in multifamily developments

The number of developments providing space for physical therapy was somewhat surprising, according to a new survey.

Architects | Jul 25, 2017

AIA 2030 Commitment expands beyond 400 architecture firms

The 2016 Progress Report is now available.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Industry Research | Jun 27, 2017

What does the client really want?

In order to deliver superior outcomes to our healthcare clients, we have to know what our clients want.

Industry Research | Jun 26, 2017

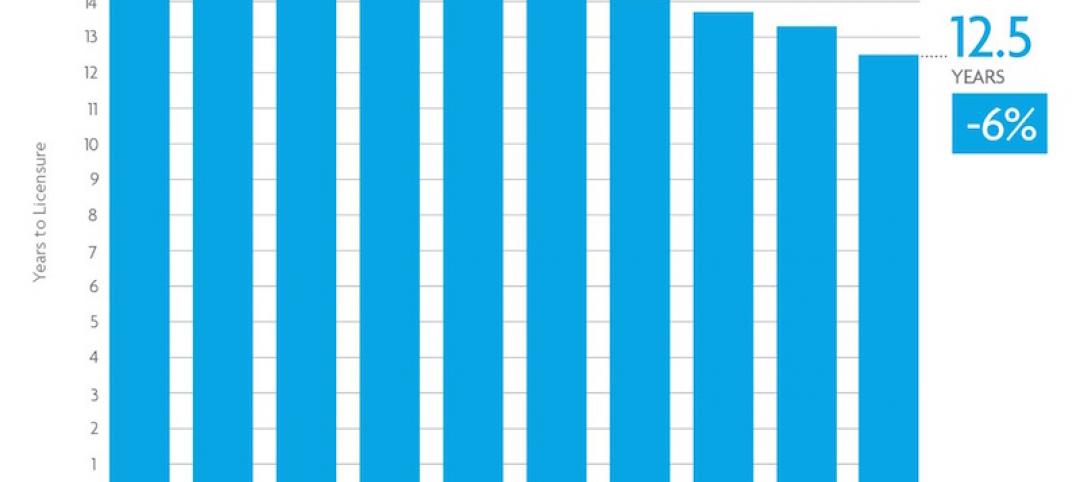

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

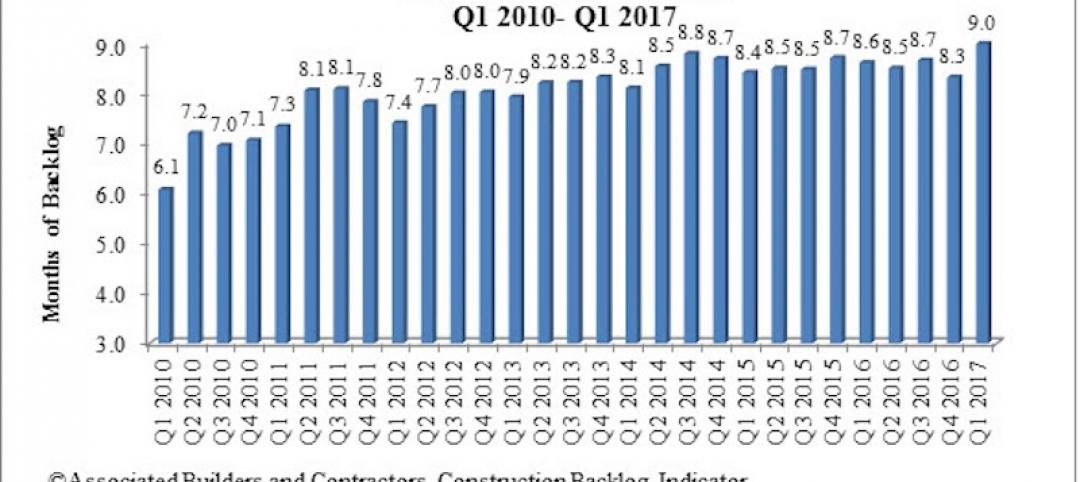

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.